Are Low-Risk Stocks Really Low-Risk?

Why are there no funds offering exposure to the best-performing factor?

March 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

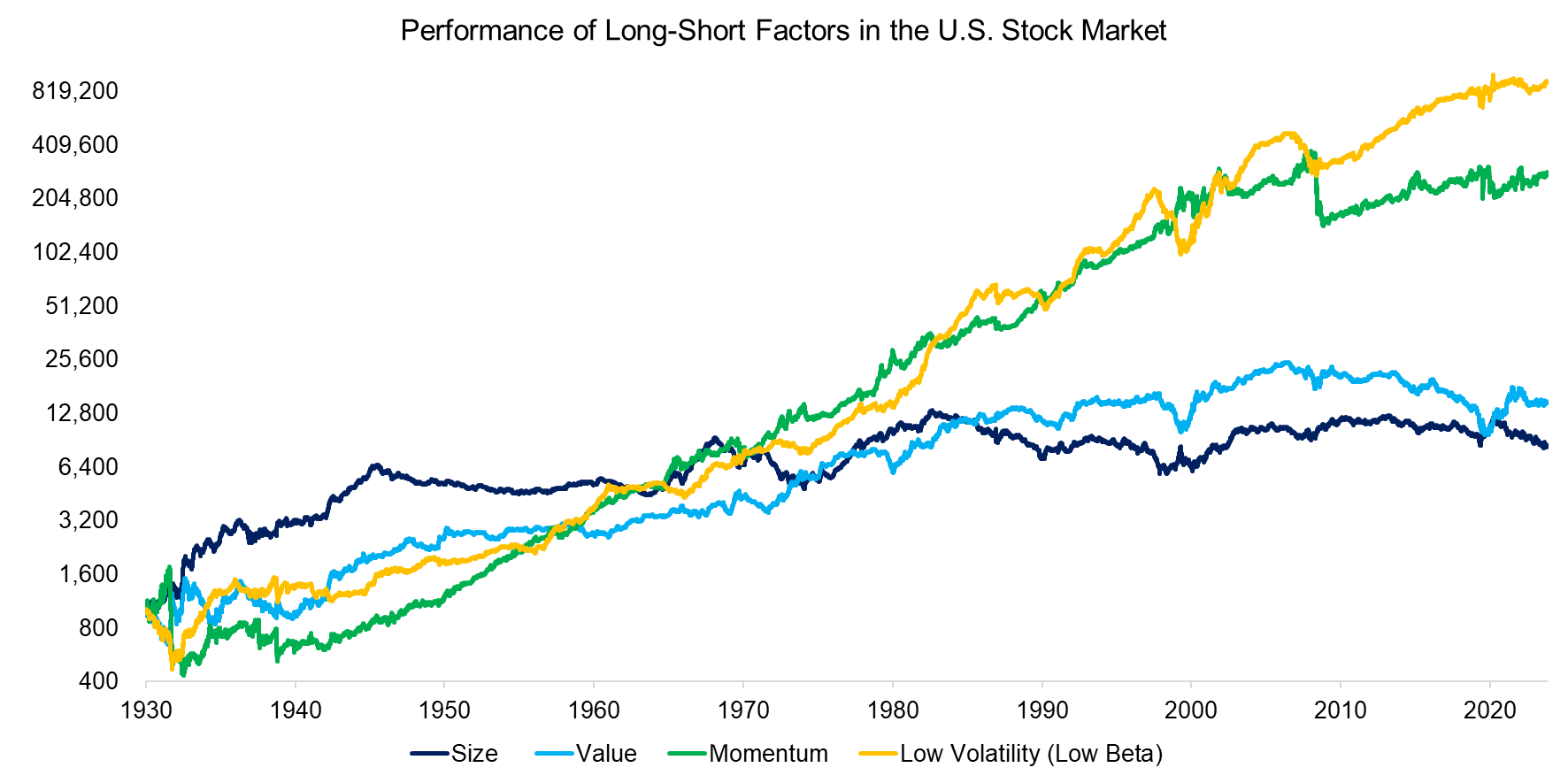

- The long-short low volatility factor generated a higher long-term return than momentum, value, or size

- However, the factor’s performance also features bear markets and crashes

- Long-only low volatility ETFs haven’t offered higher Sharpe ratios than the S&P 500

INTRODUCTION

When parents are asked who their favorite child is, the diplomatic answer is that they love all their children equally, although that may sometimes be challenging. When investors are asked what their favorite factor is, there is usually little diplomacy and one clear loser – momentum. Most investors dislike the momentum factor as they believe it is too simple to work.

However, if we review the long-term performance of long-short factors in the U.S. stock market we observe that the momentum factor vastly outperformed value and size, which are far more popular investment styles. Having said this, the low volatility did even better and generated a CAGR of 7.5%, compared to 6.2% for momentum, 2.9% for value, and 2.3% for size in the period from 1930 to 2024, based on data from AQR.