Complexity is the Enemy of Investing

A case study of a poorly designed portfolio from the world´s largest asset manager

February 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

- Financial experts create complex portfolios to justify their fees

- However, complexity does not necessarily make better portfolios

- In the contrary, these often led to unnecessarily expensive solutions

INTRODUCTION

In November 2024, SoFi, a comprehensive financial app catering to retail investors, unveiled a new robo-advisor platform developed in collaboration with BlackRock, the world’s largest and most sophisticated asset manager.

Given BlackRock’s ownership of iShares, one might have anticipated straightforward, low-cost portfolios designed to be easily understood by retail investors. Instead, BlackRock appears to have leveraged its expertise to create unnecessarily complex portfolios, seemingly prioritizing fee maximization over simplicity and investor benefit.

This article serves as a case study on pitfalls to avoid when designing investment portfolios.

PORTFOLIO ANALYSIS

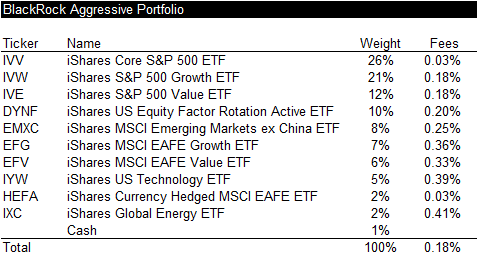

BlackRock designed a variety of portfolios for SoFi, tailored to investors’ risk tolerance and tax considerations, with sustainable investing options also available. This analysis focuses on the Aggressive Portfolio intended for retirement accounts, an all-equities portfolio.

The Aggressive Portfolio consists of 10 iShares ETFs, offering exposure to U.S. equities (77%), international equities (15%), and emerging markets equities (8%). While the management fee is 0.18%, investors must also pay SoFi an advisory fee of 0.25%, bringing the total portfolio fee to 0.43%.