Multi-Strategy Hedge Funds & Replication ETFs

Worth replicating?

July 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

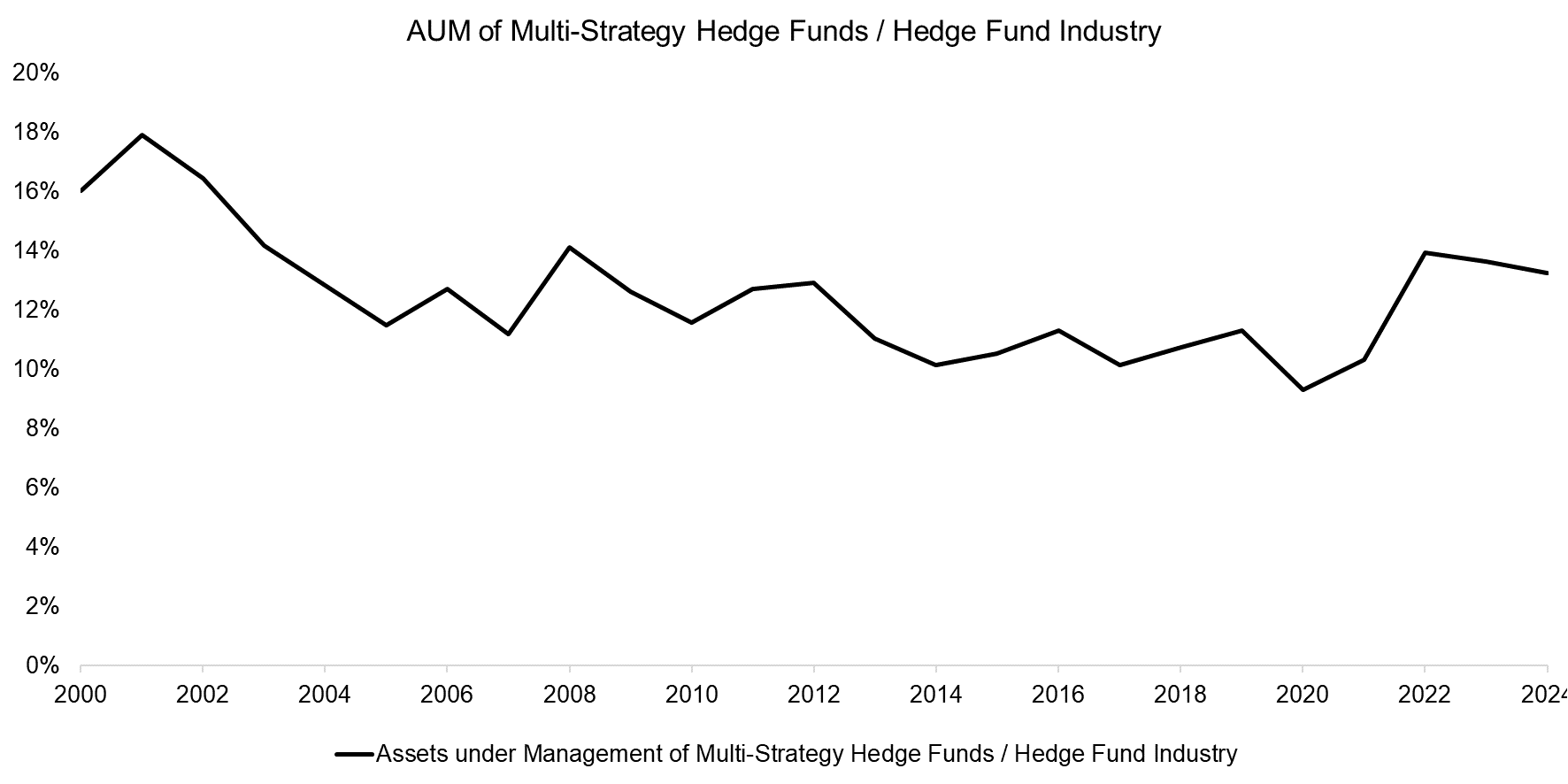

- Despite stellar returns of some multi-strategy hedge funds, the category has not gained market share

- Multi-strategy hedge funds are highly correlated to equities, offering limited diversification benefits

- Replication ETFs offer the same unfavorable characteristics

INTRODUCTION

In 2022 multi-strategy hedge funds were hot. Citadel generated a return of 38.1%, DE Shaw 24.7%, and Millennium 12.4%, stellar returns for firms managing billions with tight risk management systems. Investors were desperate to allocate capital to such firms, but their capacity was constrained. Some took advantage of the favorable sentiment by introducing or increasing the lock-up periods for invested capital, copying the playbook of the private equity industry.

However, despite this recent increase in interest, the market share of multi-strategy hedge funds has not increased significantly and remains close to its long-term average of 12%. As of the end of 2023, $682 billion have been allocated to such funds, compared to $5.1 trillion for the entire hedge fund industry, based on data from BarclayHedge.