Outperformance via Leverage

Active managers versus leveraged ETFs

September 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Active fund managers have failed to generate outperformance

- Theoretically, investors could use leveraged ETFs to generate above-market returns

- However, the Sharpe ratios of these deteriorate significantly with leverage

INTRODUCTION

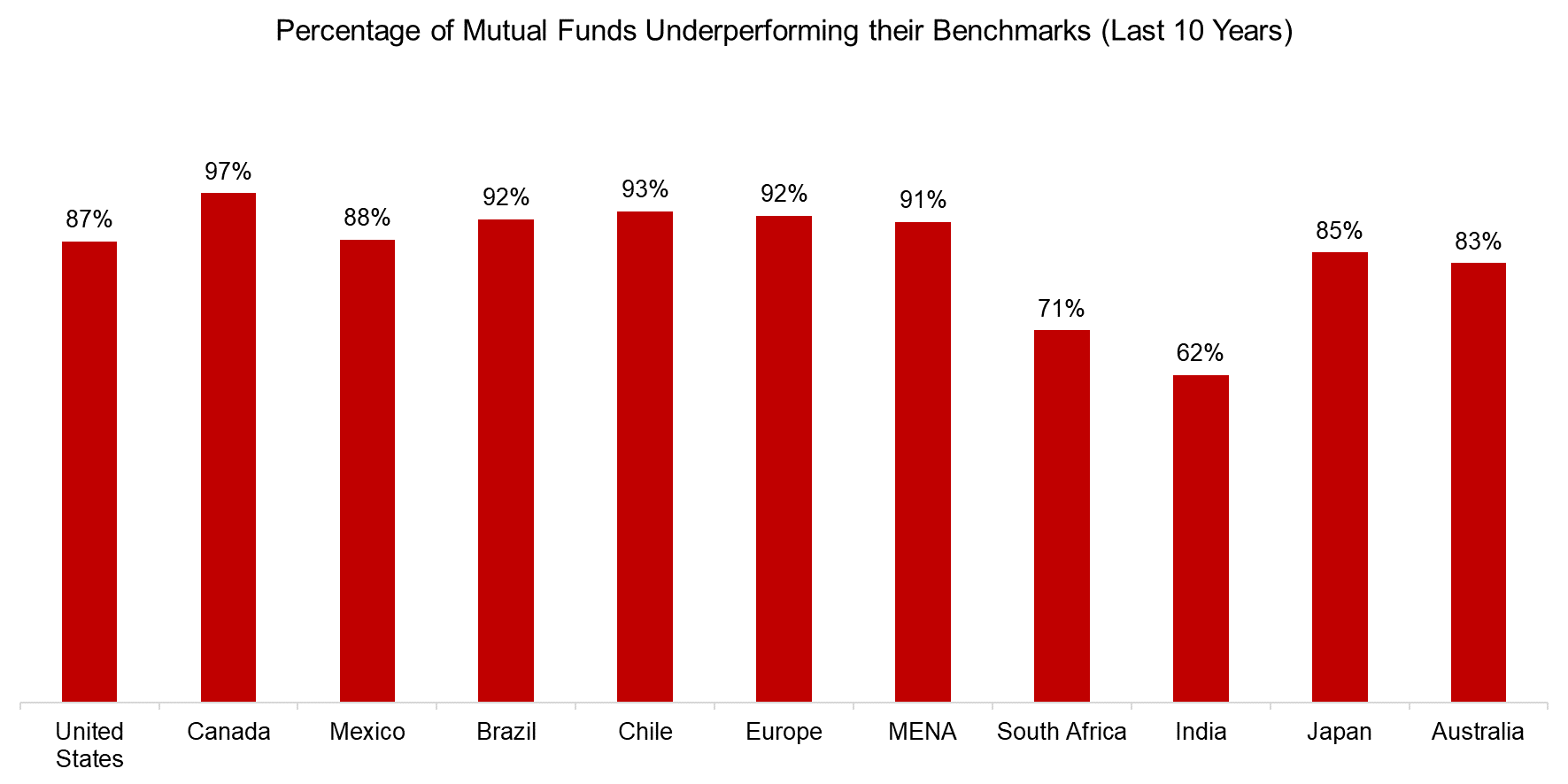

The capital asset pricing model (CAPM) assumes rational investors. However, if investors are rational, why do they allocate to actively managed mutual funds? In Canada, 97% of active mutual funds underperformed their benchmarks over the last 10 years according to research from S&P SPIVA, yet there are close to $2 trillion invested in mutual funds in Canada.

The situation is not particularly better in other markets. India seems to be the market that offers the best opportunities for generating outperformance, but only 38% of mutual funds beat their benchmarks.

Source: S&P SPIVA, Finominal

Mos