Size Factor

Is Small Cap Exposure Worth It?

- Size as a factor shows little consistency in generating positive returns over time

- Investors do not seem to get compensated for the higher risks of holding small caps

- If small cap exposure is still desired, best to implement via a small cap ETF

ORIGINS OF THE SIZE FACTOR

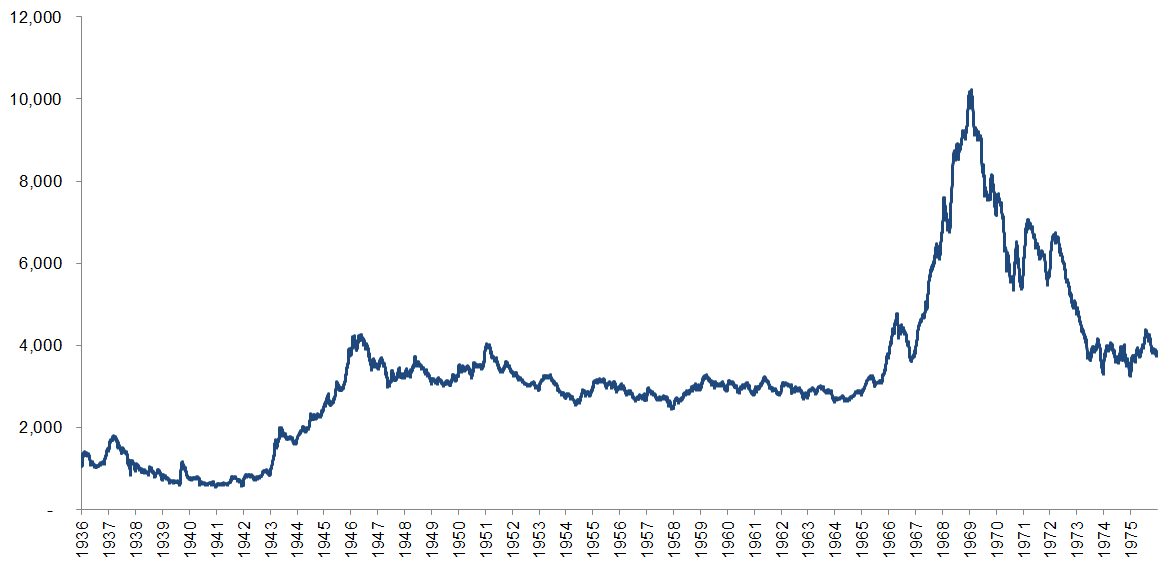

The Size factor is likely the simplest factor as it means buying companies with a small market capitalization and selling companies with a large market capitalization. The first influential paper on this factor was published by Banz in 1981, which highlighted abnormal returns from the Size effect over the period 1936 to 1975.

Using Fama-French data we can visualize the abnormal returns, which are calculated by using the difference between the bottom 10% (smallest companies) and top 10% (largest companies) for that period. It’s worth noting that the Fama-French returns are without transaction costs and include some very small companies that are too illiquid to actually trade.

Size Factor (1936 – 1975)

Source: Fama-French

The chart above does show positive abnormal returns, but very little consistency with one long period of flat returns between 1946 and 1966 and one bubble-like period between 1968 and 1972. From an academic perspective the positive returns might be interesting, but for a fund manager the inconsistency would represent a