Stock Selection versus Asset Allocation

What matters more?

November 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

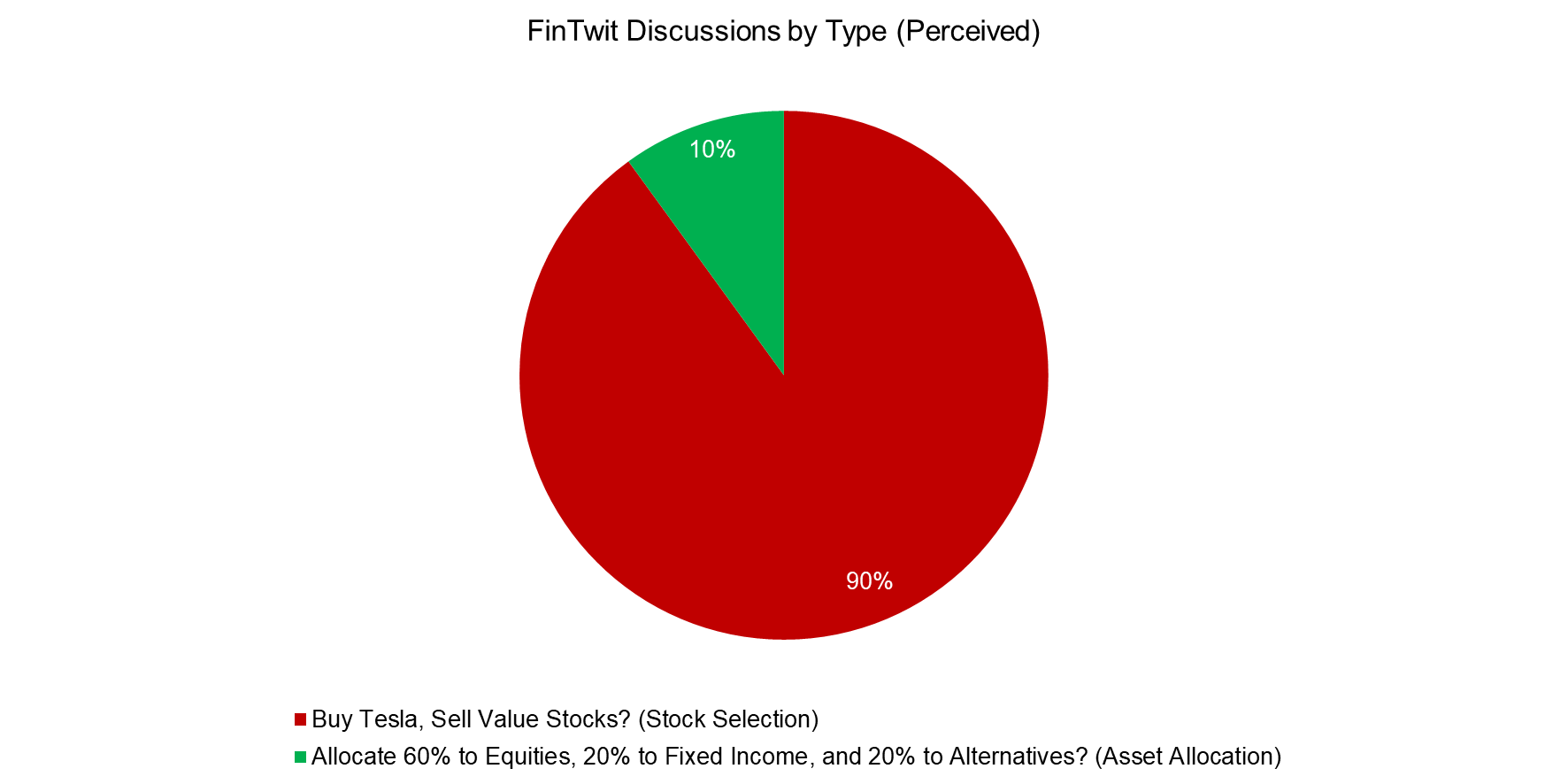

- Most investors seem to spend more time on stock selection rather than asset allocation decisions

- However, small asset allocation choices can have large impacts on expected returns

- It likely would be wise to focus more on asset allocation than stock selection

INTRODUCTION

Some of LinkedIn’s most popular financial influencers focus on educating their followers on analyzing stocks using fundamental data, where valuation and quality metrics dominate. However, what´s the point of this?

Professional fund managers have more experience and superior infrastructure than the average retail investor, yet most funds still underperform their benchmark indices. It seems like a colossal waste of time and money for folks to learn the difference between ROA and ROE and then create a portfolio of stocks, rather than buying an ETF tracking the MSCI World Index.

Unfortunately, this behavior seems to extend from retail to institutional investors, where more time appears to be spent on stock selection rather than asset allocation.

Source: Finominal

In this resear