Value vs Quality: More Correlated than Ever? II

P/E ratio of 100x vs -100x, which is more expensive?

March 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

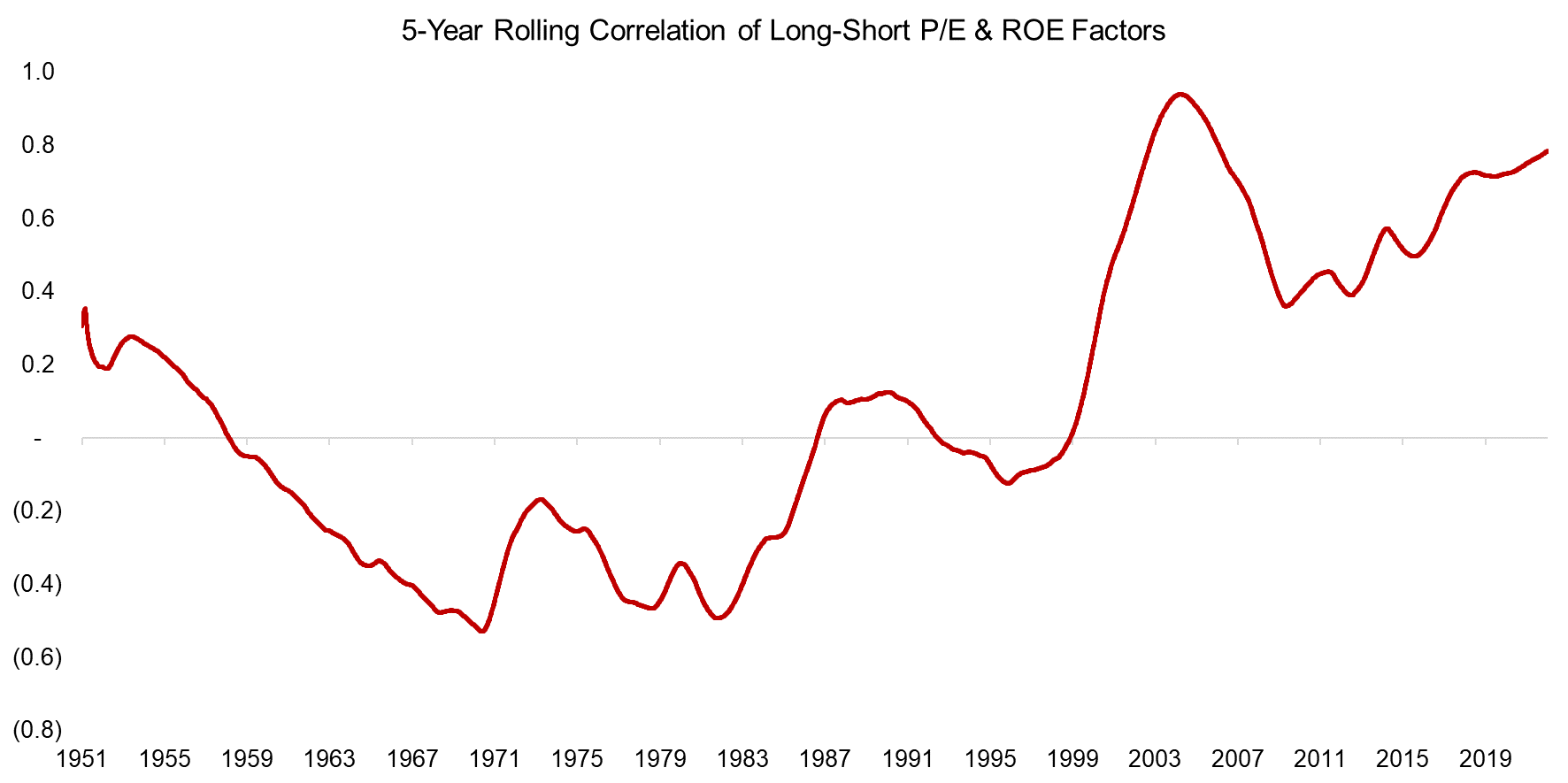

- P/E and ROE factors were highly correlated in recent years

- However, this is counterintuitive as cheap stocks should not be highly profitable

- We can explain this perplexity with stocks with negative earnings

INTRODUCTION

In our recent article “Value vs Quality: More Correlated than Ever?” we highlighted that the correlations of the long-short P/E and return-on-equity (ROE) factors have changed from negative between 1951 and 1991 to positive thereafter. Intuitively, it does not make sense as cheap stocks tend to feature low profitability, and expensive ones usually have high profitability.

We used data from two different providers, namely Jensen, Kelly, and Pedersen and Finominal, so are confident that this change in relationship is valid. The 5-year rolling correlation has been trending upward since the global financial crisis in 2009 and is close to reaching its all-time high of 0.9.